They often deal with teams, functioning as service advisors to top executives. Monetary supervisors also do tasks that are specific to their company or industry. For instance, government monetary supervisors need to be experts on government appropriations and budgeting processes, and healthcare financial managers should learn about topics in healthcare financing.

The following are examples of kinds of monetary managers: direct the preparation of financial reports that sum up and https://www.inhersight.com/companies/best/reviews/overall anticipate the organization's monetary position, such as income statements, balance sheets, and analyses of future profits or expenditures. Controllers likewise supervise of preparing unique reports needed by governmental agencies that manage services.

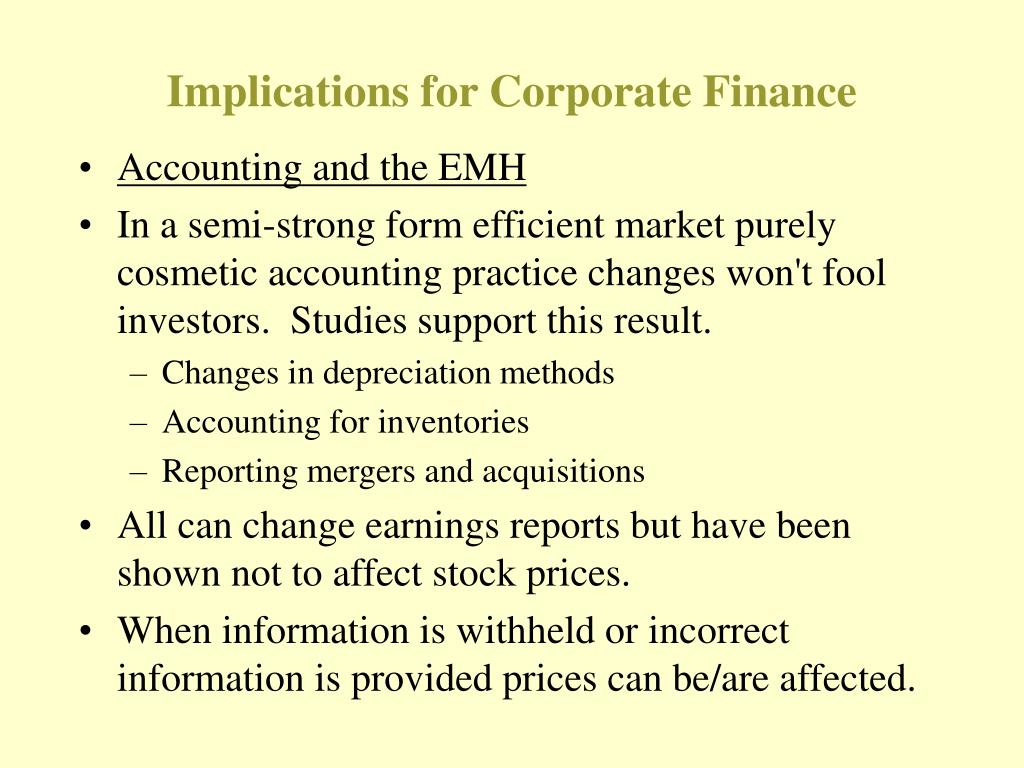

and direct their company's budgets to meet its monetary objectives. They manage the financial investment of funds and perform methods to raise capital (such as issuing stocks or bonds) to support the firm's growth. They also establish financial strategies for mergers (two business joining together) and acquisitions (one company purchasing another).

They set credit-rating criteria, figure out credit ceilings, and keep track of the collections of past-due accounts. screen and manage the circulation of money in and out of the business to fulfill service and financial investment requirements. For instance, they should project capital to figure out whether the company will have a scarcity or surplus of money.

Amongst the risks they try to limit are those that stem from currency or product rate changes. decide how best to limit a business's losses by getting insurance against dangers, such as the requirement to make disability payments for a staff member who gets hurt on the task or the expenses imposed by a claim versus the business.

Some Known Details About How To Make Money Blogging On Finance

The biggest companies of financial managers are as follows: Finance and insurance 30% Expert, clinical, and technical services 14% Management of business and enterprises 11% Federal government 7% Production 6% Monetary supervisors work closely with magnates and with departments that develop the information financial managers require. A lot of monetary supervisors work complete time and some work more than 40 hours per week.

A bachelor's degree in finance, accounting, economics, or business administration is frequently the minimum education required for monetary supervisors. However, lots of employers now seek candidates with a master's degree, preferably in company administration, financing, accounting, or economics. These scholastic programs help trainees establish analytical abilities and find out financial analysis methods and software.

The CFA Institute confers the Chartered Financial Expert (CFA) accreditation to financial investment specialists who have at least a bachelor's degree, 4 years of work experience, and pass three examinations. The Association for Financial Professionals provides the Certified Treasury Expert credential to those who pass an examination and have a minimum of 2 years of appropriate experience.

Monetary managers typically have experience in another business or monetary occupation. For instance, they may have worked as a loan officer, accounting professional, securities sales representative, or financial analyst. Sometimes, business provide official management training programs to assist prepare extremely motivated and proficient financial employees to become monetary managers.

These executives are responsible for the precision of a whole company's or organization's monetary reporting. Monetary managers increasingly are assisting executives in making decisions that affect their organization, a job that needs analytical capability. Exceptional interaction skills are important because financial supervisors should describe and justify complicated monetary deals. In preparing and examining reports such as balance sheets and earnings declarations, monetary managers must be exact and mindful to their work in order to prevent mistakes.

How How Does M1 Finance Make Money If Its Free can Save You Time, Stress, and Money.

An understanding of global finance and complex monetary documents likewise is very important. Because financial supervisors handle a variety of info and files, they should stay arranged to do their jobs successfully. The mean yearly wage for monetary supervisors is $129,890. The typical wage is the wage at which half the employees in an occupation made more than that amount and half made less.

The typical annual salaries for monetary supervisors in the top industries in which they work are as follows: Specialist, scientific, and technical services $152,810 Management of business and business $145,280 Production $130,900 Finance and insurance coverage $125,600 Government $114,250 A lot of financial managers work complete time and some work more than 40 hours each week.

Nevertheless, growth will vary by industry. Services offered by financial managers, such as preparation, directing, and coordinating investments, are most likely to remain in demand as the economy grows. In addition, numerous specializeds within financial management, particularly cash management and risk management, are expected to be in high need over the next years.

As globalization continues, this pattern is most likely to continue. This must lead to demand for monetary supervisors as companies will be in need of cash management expertise. There has actually been an increased emphasis on threat management within the financial market, and this trend is expected to continue. In action to both the monetary crisis and monetary regulatory reform, banking organizations will put a higher emphasis Find out more on stability and handling threat rather than on maximizing revenues.

The credit intermediation and related activities' industry (that includes industrial and savings banks) utilizes a large percentage of financial managers. As bank consumers increasingly perform transactions online, the variety of bank branches is anticipated to decline, which must limit work growth in this sector. However, employment decreases are anticipated to primarily impact clerical professions, such as tellers, rather than financial supervisors.

Getting My Why Do Finance Majors Make So Much Money To Work

See all finance tasks. Similar to other managerial occupations, jobseekers are most likely to deal with competition since there are more candidates than job openings. Candidates with proficiency in accounting and financeparticularly those with a master's degree or certificationshould take pleasure in the finest job prospects. Work forecasts data for Financial Managers, 2018-28 Occupational Title Employment, 2018 Projected Work, 2028 Modification, 2018-28 Percent Numeric Financial managers 653,600 758,300 16 104,700 A part of the details on this page is used by approval of the U.S.

Are the you always see so pleasurably promoted the right course for you? In case you have actually been asking yourself this concern for a long time now and have not had the ability to find a suitable response, there's no requirement to worry. This piece is here to information all you require to understand.

Last, but not least, we'll supply you with a comprehensible list of all the professions in financing available on the job market as we speak. Discover Wall Street Skills Ace the Interviews Get the Finest Job Leading Training Provider 41053+ Consumers Life Time Professional Support 90-Day money-back guarantee $347-Value Reward Apart from that, most significantly, we have actually also shared an easy-to-understand and follow 'how-to' guide for protecting among these positions.

If you can, high school is a perfect place to begin. Take the suitable finance degree, such as mathematics, economics, calculus, and everything in between and ace them. This action requires to be underlined ace them. The greater your grades in high school, the better your possibilities of getting into an Ivy League college are. Some have degrees particular to the field of financial management. Employers generally require applicants to have 5 or more years of experience in addition to an academic credential in order to handle this innovative role. The University of Maryland-Baltimore County offers a Bachelor's degree in Financial Economics that features preparatory courses for jobs in monetary management.

Students who desire a more targeted degree might consider National University's BS in Financial Management. This degree program can be completed online or on-campus and consists of courses like Financial Planning, Finance and Banking, and International Financial Management. Often described as securities analysts or financial investment analysts, financial analysts are responsible for overseeing a corporation or company's financial investments.

How To Make A Lot Of Money With A Finance Degree - Questions

Financial analysts might focus on a specific type of analysis. There are portfolio managers, ratings analysts, fund supervisors, and danger experts, for instance. Though the need for financial experts is growing at a consistent rate, according to the Bureau of Labor Data (BLS), competitors for these positions is intense. The high earning capacity connected with jobs in financial analysis brings in much more candidates than there are positions to fill (how much money can you make with a finance degree).

Some companies choose candidates with a Chartered Financial Expert (CFA) accreditation, for instance. Official work requirements for tasks in financial analysis usually include a minimum of a bachelor's degree. One leading program prospective financial experts can think about is California State University- Northridge's Bachelor of Science in Financing alternative with a focus in Financial Analysis.

Louisiana State University- Shreveport uses a comparable program that can be completed online. Core courses required for the degree consist of Advanced Service Finance, Investment, and International Finance. Among the fastest-growing careers in our ranking, "operations research expert" is a solid answer to the concern: "what can you make with an economics degree?". how to use google finance to simulate how much money you make.

This is much faster than the typical projected development for occupations in the United States. This increased need can be attributed in big part to technological developments that allow services to translate data more accurately and utilize the findings to make better business and financial decisions. Responsibilities for operations research experts might differ depending upon the market they work in along with their particular employers.

A bachelor's degree is needed for lots of positions in operations research study analysis, though some companies prefer to work with applicants with a more innovative degree. Columbia University in the City of New york city uses a highly targeted Bachelor of Science in Operations Research Study (BSOR) program for trainees thinking about becoming an operations research analyst.

The smart Trick of How Does Oasis Legal Finance Make Money That Nobody is Talking About

Southern New Hampshire University offers an equivalent online choice. Its online BS in Operations Management features concentrations in Job Management and Logistics & Transportation. Sample course titles include Management Science Through Spreadsheets, Trends in Operations Management, and Constant Enhancement Tools and Strategies. Another possibly financially rewarding career for economics majors is that of a marketing research expert.

They're particularly important to companies releasing brand-new item lines or using brand-new services to customers. In the age of huge data, the demand for marketing research analysts is growing at a quick rate. The Bureau of Labor Statistics (BLS) anticipates a 20% rise in employment opportunities for these professionals in between 2018 and 2028.

Furthermore, the competition for readily available positions is still high, despite the increase in task potential customers. Aside from pursuing a graduate degree, analysts can make themselves more appealing to prospective employers by earning the Professional Researcher Accreditation (PRC) from the Market Research Association. Colorado State University Global uses students a hassle-free pathway to a career as a market research study expert through its online bachelor's degree in marketing.

For students who prefer a postgraduate degree in the field, Texas State University uses an MS in Market Research and Analysis. Offered through its McCoy College of Organization Administration, the program features upper-level marketing and economics courses such as Strategic Marketing Analysis and Planning, Accounting Analysis for Managerial Choice Making, and Marketing Research Study Techniques, for instance.

Actuaries are monetary and financial experts that evaluate the possible danger that a particular event may occursuch as a natural catastrophe or illness, for exampleand assistance companies and businesses prepare for and decrease the cost of said risk. A big number of actuaries are used by insurer. There are different types of actuaries such as life insurance coverage actuaries, enterprise threat actuaries, residential or commercial property and casualty insurance coverage actuaries, and medical insurance actuaries, for circumstances.

The 10-Minute Rule for How To Make The Most Money With A Finance And Math Degree

Still, it remains a small field, and the pursuit of tasks will be competitive. A bachelor's degree in a field such as mathematics, data, or economics is usually required for entry-level tasks in actuarial science. Some companies might also require expert certifications such as those used by the Casualty Actuarial Society (CAS) or the Society of Actuaries (SOA).

In 2018, the school was acknowledged for its exemplary profession preparation for actuaries by the Casualty Actuarial Society (CAS). Also typically described as management specialists, management analysts recommend service managers on strategies to improve profit by reducing costs and increasing profits for a company. In order to provide the very best consult, these monetary professionals need to thoroughly review a corporation's financial files and accounts.

Numerous management analysts specialize in a specific industry or kind of management. Jobs for management analysts are growing quicker than typical, according to the Bureau of Labor Statistics (BLS). As business continue to search for methods to be more rewarding, job opportunity in management consulting are predicted to grow at a fast rate.

A bachelor's degree in economics or an associated field such as finance or accounting is needed in order to get in the field of management analysis. Some employers might prefer additional qualifications such as an MBA, for circumstances, or professional accreditation as a Certified Management Specialist (CMC). For those thinking about pursuing a career in management analysis or consultancy, West Texas A&M University offers a Bachelor of Company Administration (BBA) in Economics and Finance from its popular Paul and Virginia Engler College of Organization.

Eastern New Mexico University uses a comparable program that can be completed online. The university's BBA in Applied Economics and Financing prepares trainees for operate in financial consulting immediately after graduation. Scholarships and financial help are offered for qualified students. Many students who contemplate the question "what can you make with an economics degree?" end up having a lot more concerns also.